The approach I take when teaching my students about money and finances is: Learn by doing. I believe people learn best by using facts in real-life contexts. The more kids are challenged to solve meaningful problems using their math skills, the more the answers will become ingrained in the child’s long-term memory, easily accessible for future use.

The Ontario Curriculum requires students be able to name our coins and solve simple math problems using dollar amounts, however, teachers must encourage kids to go beyond this basic understanding of money to provide true financial literacy. Kids need to understand how money works: how to save it, borrow it and donate it to others. Young people need to know how to budget, pay bills, and overall, how to manage their money properly.

How can you teach your kids about money at home? Here are 5 fun strategies to get you started:

I successfully used this method in my classes, students were able to earn “scholar dollars” for jobs they did at school. On Fridays, the school store was open for the students to spend their money. Fines were imposed for breaking certain rules. If a student frequently lost school supplies, they would have to rent them from the teacher’s desk for a small fee. Students interviewed and were hired as the banker, store employees, desk clerk and other jobs in the classroom. These students revelled in the responsibility and really rose to the challenges of the program.

A similar program can be adapted in your home, using real or fake money. Kids gain a sense of pride, as well as some financial insight, when they take responsibility for their own money.

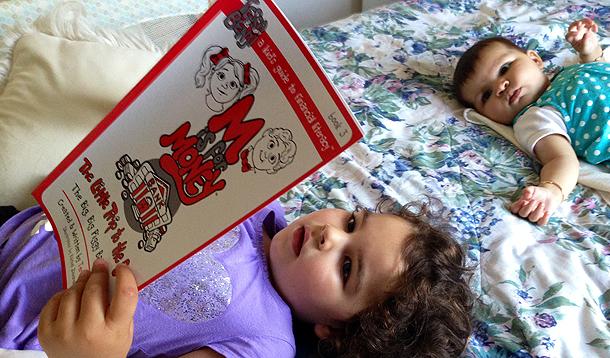

When mastering a new skill, it is important to present information in a variety of ways and allow kids to interact with that information. Stories and games are two great activities to reinforce learning, without relying on memorization. When trying to teach younger kids about money, consider the program M is for Money, authored by successful Canadian entrepreneur, Teresa Cascioli.

M is for Money is a series of nine books, aimed at children ages five through nine, which follow the financial adventures of seven year old twins, Tessa and Benji. In the first three books: The Little Piggy Bank, The Little Lemonade Stand, and The Little Trip to the Bank, the twins learn about (and teach your kids!) about saving and spending, how earning money can require hard work (but can also be very rewarding), all about bank accounts and so much more. The steps to set up a token economy are also outlined (see point #1). There are games and activities at the end of each book and in the free, downloadable teaching guide. There are also extras such as magnets, bookmarks, and notepads that are available for purchase.

By anchoring the money concepts in a narrative, M is for Money allows kids to relate to the characters and their understanding of finances. The books provide a great opportunity for questions, conversation and further exploration. The activities in the books and teaching guide offer fun ways for kids to practice what they have learned.

The first three books in the M is for Money series are available now in eBook, soft and hardcover format at www.MisforMoney.ca, Indigo/Chapters, Mastermind Toys and other retailers across Canada. Also available for download are colouring games, a lemonade stand activity, songs, money games and activities. You can also print reward and achievement certificates for your children or students each time they achieve a milestone of financial success. Together, all of these tools help to bring money concepts alive for young kids.

Sometimes your kids may hear a message better from someone else. Do you know a store or restaurant owner? A charity worker? A successful entrepreneur? Let your children hang around them for a while and talk about what it takes to run a business. I know my daughter has already picked up an understanding of money by spending time at her father's restaurants, and she is not yet three years old.

Kids have great ideas. If your child feels passionate about one of her ideas, help her bring it to market. I once supported an inspiring team of students in creating, producing and marketing a product to earn money for a charity. The students, ages nine through eleven, ran the entire project, from inception to the final donation of money, including showcasing their design at a business expo. Although I was there to guide the team, the kids surprised me with how much they could complete on their own. It’s all about learning through doing! In today’s social media driven world, it’s become much easier to get a message out there. If your child has a great idea, support them in bringing it to the people. The learning will stay with them for a lifetime.

As a child of the 80’s, I coveted a Cabbage Patch Kid to adopt and care for. I remember my parents answering my pleas with, “We will not spend $24.99 on a doll.” I was told if I wanted a Cabbage Patch Kid, I would have to buy her myself. I scrimped and saved my $2/week allowance for months. When I had enough, my dad took me to the store and Loretta Yetta became part of my family. I loved her all the more for the financial sacrifice it took to get her, and to me, that yarn-haired baby was worth every penny. I have never forgotten that lesson. Some things are worth saving for. I don’t know what will be the coveted item when my daughters are old enough for this lesson, but I am sure the price tag will be heftier than $24.99. Whatever the cost, there will come a time when my daughters will also have to scrimp and save to get what they want (as long as I can keep their doting grandparents, the very people that taught me that lesson in savings, from giving in to their demands!).

Forget about memorizing the names of coins and counting up totals on flash cards – let your kids learn by doing. They may just surprise you with their developing business savvy! The point of education is to equip our kids with the tools they need to succeed in the future. Without a strong understanding of money concepts, young people will be unprepared to cope when financial hardships strike. The human brain develops in leaps and bounds in the first decade of life. This is a great time for kids to learn about finances and develop healthy, positive view of money.