Most people don't plan on dying at a young age (yep, I'm diving right into this morbid discussion) but the reality is that it happens.

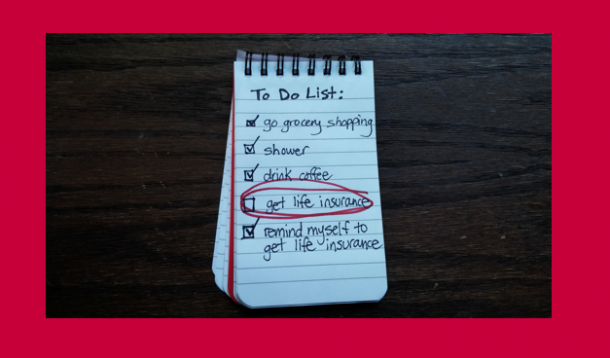

It's really crappy, it sucks, it's not fair, but it happens. So my husband and I recently decided we should finally tick some things off of our Grown-Up To-Do List, and making a will was one of those things. (It had actually been on our list for the last two years...procrastinate much?) But, we did it. And we had to make some really tough decisions, so we did what any educated grown ups would do: we threw some names into a hat, played rock scissors paper, flipped a coin and called it a day. Signed. Sealed. Done.

Phew.

Then we scrolled further down our Grown-Up To-Do List and realized that we needed more life insurance. We both have insurance through work, but it's not enough. Sure it seems like a small jackpot right now, but when you consider how much our grocery bill is each month *gasp*, and our son's addiction to truck toys, we quickly realized it wasn't enough.

That's when I started to research just how much life insurance we actually needed.

Here is some of what I learned:

My research was helped by looking at Empire Life's 10 Misconceptions About Life Insurance article.

So my husband and I put on our grown-up hats again and decided to purchase more life insurance. We've come that far. Now we just need to actually purchase more life insurance (one step at a time, it took us two years to make a will, remember?) Since I am such a deal hound, we will definitely be speaking with the people at Empire Life. Their rates for term insurance are very competitive (sometimes much lower than mortgage insurance offered by banks) and they have a 99% claim fulfillment rate.

But seriously, unless we want to leave our kids with a collection of antique spoons to help them get through University should something happen to us, we'd better get our butts in gear. We don't want to be those people. You know. The people that die without life insurance, because that would be dumb.

And speaking of dumb ways to die, check this video out and get ready to be singing it for days!

So be honest — do you have life insurance? If not, what are your reasons?

Are you one of the 65% of Canadians who has no life insurance coverage or inadequate coverage?

Empire Life makes buying term life insurance simple and affordable with an easy-to-use online “Fast & Full” application process that you can use with your insurance advisor. For more information on Empire Life or to get an insurance quote and learn more about insurance that will work for you, visit empirelife.ca. Because the dumbest way to die is without Life Insurance.

This is proudly sponsored by our friends at Empire Life.

www.empirelife.ca

Dumb Ways To Die.™ characters are officially licensed to The Empire Life Insurance Company. © Metro Trains Melbourne, Dumb Ways To Die.™ All Rights Reserved.

Registered trademark of The Empire Life Insurance Company. Policies are issued by The Empire Life Insurance Company.